The health care system is complex, but savvy consumers can receive quality care for less.

IN THE LAST FEW YEARS, consumers have found themselves paying a higher percentage of their medical costs. The Affordable Care Act has given more Americans access to health insurance, but many of those plans come with high deductibles – which are also becoming more common in employer-provided plans.

The average deductible for workers with employer-provided health insurance grew from $826 in 2009 to $1,217 in 2014, according to the Kaiser Family Foundation, with the percentage of insured workers who face a deductible of $1,000 or more growing from 6 percent in 2006 to 32 percent in 2014. Plans offered in the ACA exchange have an average deductible of $5,081 for an individual and $10,386 for a family for the bronze plans, the most popular of the four “metal” tiers, according to an analysis by HealthPockets.com.

This change has made it important for consumers to approach medical care as they do other purchases – shopping for not only quality, but also price. Unfortunately, the system doesn’t make that easy.

“You’re going to be really frustrated when you try to act like a consumer,” says Jeanne Pinder, founder and CEO of ClearHealthCosts.com. “You’re going to be really frustrated because the system is broken.”

The first rule, say experts and advocates, is to ask a lot of questions: Is that test really necessary? Is there a generic version of that medication? Are there less expensive alternatives to this treatment? And, finally, how much is this procedure going to cost?

“Doctors that are a little more in tune will acknowledge that health care costs are high,” says Carlo Reyes, assistant medical director of Los Robles Hospital & Medical Center’s emergency department in Thousand Oaks, California. “Doctors are becoming less and less off-put by patients saying, ‘I want to keep my health care costs low.’”

Pinder, a former New York Times editor, started ClearHealthCosts in 2011 to make health care costs more transparent. The site includes costs for common procedures in seven metro areas – New York, San Francisco, Los Angeles, Dallas-Fort Worth, Houston, San Antonio and Austin, Texas – plus what Medicare pays for those procedures in cities all over the country.

But shopping for gallbladder removal or a knee replacement, for example, may mean calling individual doctors’ offices, hospitals, free-standing clinics and your insurance company. And even after making all these calls, you still might not get any good answers.

“It is very difficult to find these things out,” says Tracy Watts, a senior health benefits consultant at Mercer, a human resources consulting firm. “The more complicated the procedure is that you need, the harder it is to pinpoint a price.”

Nailing down a price is difficult because there are multiple players involved in most procedures. One clinic’s fee may include the surgeon, anesthesiologist and facility. Another may bill separately for each. That means before committing to anything, you need to ask who is going to be involved in the procedure, make sure they’re all part of your insurance plan and then compare prices.

If a high deductible means you’ll be paying most of the bills yourself, you may want to ask for the cash price, which could be lower than what you would pay if you use your insurance, says Michelle Katz, a nurse in Los Angeles who runs HealthCareHacker.org and just published her third book, “Healthcare Made Easy.”

“It’s a matter of being your own advocate,” Katz says. “It can be the difference between paying $150,000 for a procedure and $30,000 for a procedure.”

Despite the complexity of the system, there are things consumers can do to get better health care for less. Here are 12 ways to save money on health care.

Pick the right insurance policy. That takes some work, Katz says. Someone in Fort Lauderdale, Florida, for example, has a choice of 94 plans through the Affordable Care Act exchange, as well as plans outside the exchange. You want a plan that includes your doctors and your medications, plus provides care for any chronic conditions. Information online can be incomplete or outdated, so call the doctors to make sure they’re still participating in plans you’re considering.

Shop around for medication. GoodRX.com lists cash prices for generic Lipitor in Fort Lauderdale ranging from $12.60 at Publix to $30.25 at CVS, with coupons on the site. The site doesn’t include Costco, whose pharmacy is open even to nonmembers and often has lower prices for drugs. Wal-Mart, Target and many supermarkets offer $4 generic drugs – but not the same ones – which may be less than your insurance copay.

Know what your health insurance policy covers. The time to dig into your policy is before you need to use it. Find out about preapprovals, emergency room visits, copays for doctor visits and coinsurance for procedures.

Ask whether tests, prescriptions or procedures are really necessary. The latest drugs aren’t always better than older, cheaper drugs, Reyes notes. If you tell the doctor you’re paying cash for what she orders, she may suggest you wait to see if the condition resolves before ordering an expensive test. Instead of paying for 20 sessions of physical therapy, pay for one and learn exercises to do at home.

Ask for prices upfront, and ask about discounts for cash payments. This may require calling your insurance company, doctor and hospital to find out what a procedure or an office visit will cost. Remember that some doctors and facilities will offer a discount if you pay cash.

Pick the right facility. If your condition isn’t life-threatening, don’t go to the emergency room. A persistent cough or a broken finger may be better treated in a store clinic or an urgent care center at a much lower cost. But not all clinics or urgent care centers are the same. Investigate the facilities near you before you need them so you can make the right choice when you’re ill.

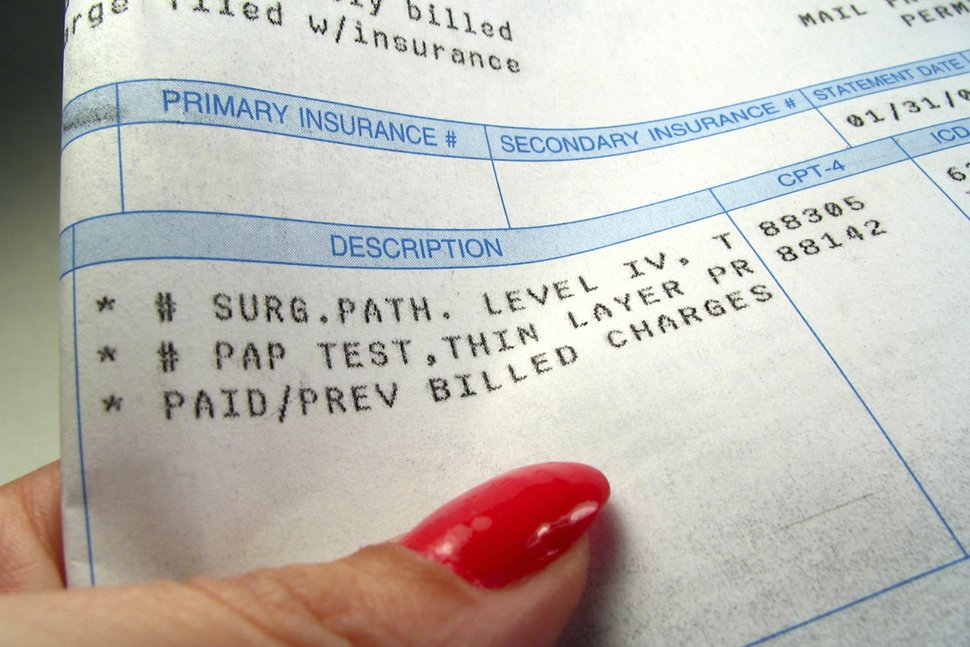

Check bills and insurance company statements for errors. Even those with the best insurance policies often get bills for procedures that should be completely covered. A mistake in coding can mean the difference between a mammogram with no copay and one that costs $600. Be vigilant in checking both bills and explanations of benefits, a statement that summarizes which procedures and services are covered and those that remain for you to pay. Keep records of whom you talked to and when, because the calls are often recorded.

Get copies of all your medical test results and records. Bringing those with you to consultations can cut the number of tests and office visits you need. Often, if you’ve had a test recently, there is no need to repeat it. Plus, if you visit a doctor with test results in hand, she can advise you immediately rather than needing to set up another appointment after test results arrive.

Take advantage of free screenings. Every community has health fairs that offer free screenings for diabetes, HIV, high blood pressure and other maladies. By law, ACA-compliant insurance plans offer a number of screenings with no copays.

Negotiate big medical bills. If you go into a hospital or undergo an expensive procedure, get an itemized bill, preferably before you leave the hospital. Once you’ve made sure it’s free of errors, ask the hospital billing department for financial aid, a discount for paying in cash or a payment plan. If you have lots of big bills, consider hiring someone to negotiate for you.

Consider online, telephone or video consultations. Some doctors offer email consultations. American Well is among the companies that offer video consultations with doctors ($49 for 10 minutes). Some insurance companies and employer plans offer free telephone hotlines that can answer questions, sometimes 24 hours a day, to help you decide if you need an urgent care visit.

Practice preventive care. That means taking prescribed medications, keeping up a healthy lifestyle and visiting your primary care doctor for treatment of chronic conditions. “Chronic conditions can be better treated if they’ve not progressed to a more serious phase,” Reyes says. “To treat disease is much more expensive than to prevent disease.”